Homeowners

Homeowners

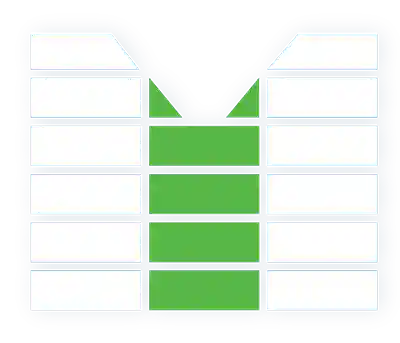

Your home insurance covers your home, other structures, personal property, loss of use, liability, and medical payments. Other coverages are also available.

Home/Dwelling Coverage:

Protects your home in the event of a covered loss. The coverages are written to repair/replace your home with the same like, kind, & quality that it was before the loss. A home policy can be written with Guaranteed Replacement Cost, which means your home is insured to 100% of its replacement cost. It also can be written with Extended Replacement Cost, which is available to risks that are not eligible for the Guaranteed Replacement option. Each company offers their own additional limit of coverage with the Extended Replacement option.

Other Structures:

Covers damage to unattached structures on your policy. This includes items such as sheds, unattached garages, fences, satellite dishes, & pools.

Personal Property/Contents:

This covers damage to your personal property within your home due to a covered loss.

Loss of Use:

If you are unable to stay living in your home due to a covered loss, this pays for a percentage of your living expenses, such as lodging and food.

Liability:

Covers you if a claim is made, or a law suit is brought against you, for bodily injury or property damage that you are legally liable to others.

Medical Payments:

Covers medical payments to others that are injured on your property.

Optional Coverages can be endorsed to your home policy. Each company varies with the limits and options they offer. Some examples are listed below:

-

Replacement Cost On Contents:

Your contents are replaced with same like, kind, quality, with no depreciation, in the event of a covered loss.

-

Back Up of Sewer/Sump Pump Failure:

Your home and/or contents will be covered up to the limit selected on your policy for a covered claim resulting from your sewer backing up or your sump pump failing.

-

Scheduled Items:

Items such as jewelry, fine arts, silver, furs, guns, musical instruments, computers, collectibles, cameras & antiques can be added to your policy with a value limit it would cost to replace the item. Scheduled items are not subject to your home deductible & are also covered for mysterious disappearance.

These coverages may also apply to condos, tenants, mobile homes, & farms. We work to tailor your policy to your specific needs.